The profit sharing percentage remains at 10% of those generated by the employing entity, in accordance with the resolution of the Sixth National Commission for Workers’ Participation in Company Profits, published in the Official Gazette of the Federation on September 18, 2020.

In accordance with the provisions of the Federal Labor Law, all workers will have the right to participate in profit sharing, subject to the following rules and exceptions:

The amount of the profit sharing will have a maximum limit of three months of the worker’s salary or the average of the participation received in the last three years; the amount that is most favorable to the worker will be applied.

The distributable profit will be divided into two equal parts; the first will be distributed equally among all workers, taking into account the number of days worked by each one during the year, regardless of the amount of salaries; the second will be distributed in proportion to the amount of salaries earned for the work performed during the year.

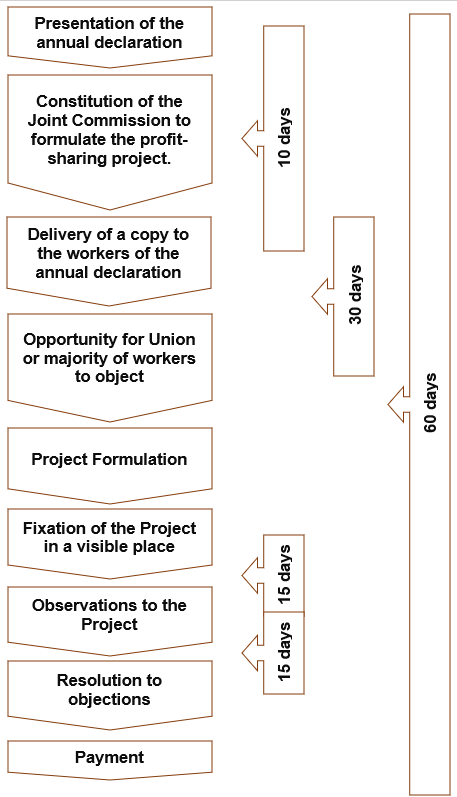

The distribution of profits among workers must be made within sixty days following the date on which the annual tax must be paid.

The process for profit sharing is summarized in the following scheme:

To demonstrate compliance with the obligations contained in the Federal Labor Law regarding profit sharing, we recommend having the following documentary information:

Receipts showing the payment of profit sharing.

We hope that this information is useful to you and we remain at your disposal for any questions or comments you may have regarding it.

Sincerely,

ILC Integral Labor Consulting, S.C.