2024

As per the resolution of the Sixth National Commission for Workers’ Participation in Company Profits, which was published in the Official Gazette of the Federation on September 18, 2020, the percentage of profit distribution will remain at 10% of those generated by the employing entity. In accordance with the Federal Labor Law, all workers will have the right to participate in profit sharing, subject to certain rules and exceptions.

The distributable share will be divided equally into two parts; the first will be equally distributed among all workers, taking into account the number of days worked by each in the year, regardless of the amount of their salaries; the second part will be distributed in proportion to the amount of salaries earned for work performed during the year.

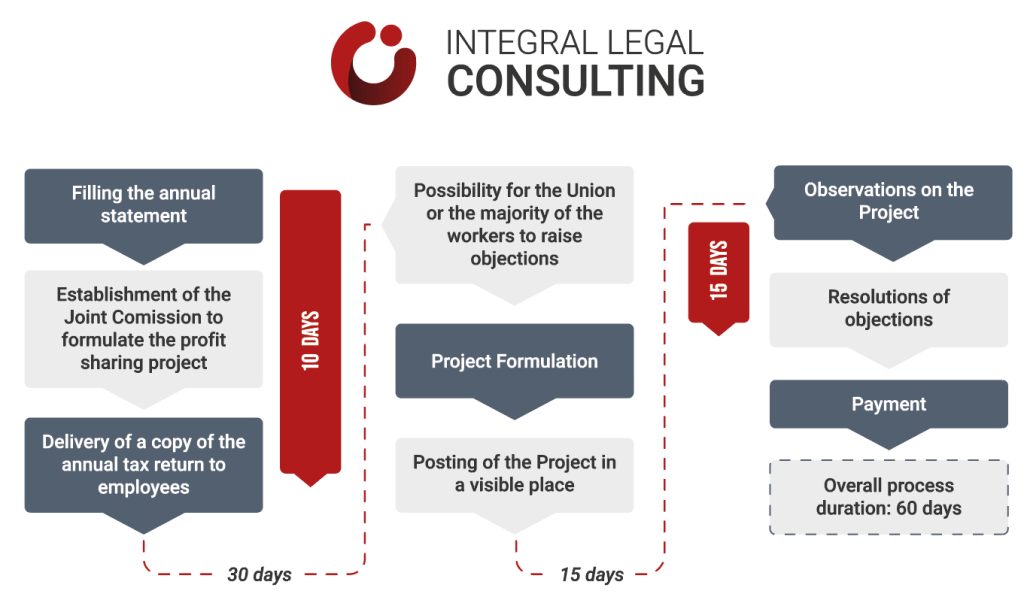

The distribution of profits among workers must be made within the sixty days following the date on which the annual tax must be paid.

The process for distributing profits can be summarized as follows:

In order to prove compliance with the obligations contained in the Federal Labor Law regarding profit sharing, we recommend having the following documentary information:

At ILC we can help you prepare and review the necessary documentation to comply with this labor obligation.

Tips and/or practical comments

Taking into consideration that last year, there were many incidents in different work centers and in different states of the Mexican Republic, derived from workers’ disagreements about the amount to be distributed or the determination that there were no profits, we recommend taking the following preventive actions:

We hope you find this information useful, and we remain at your disposal for any questions or comments you may have regarding this information.

Following on from what we have referred to in the “practical advice” section, a strategy that should be used by those work centers that commonly generate few profits to be distributed, is to periodically indicate to all their workers, during the same year in which profits should be generated, the results of the company’s operations, The aim is to ensure that employees are aware of the situation at all times, so that they do not generate a false expectation about the distribution, or a mistaken one based on indicators that are wrongly taken as a reference on the company’s status, such as, for example, continuous and/or constant overtime work.

Sincerely yours,